ANALYSIS THIRD QUARTER 2020

Context

The underlying LVS account in Darwinex has closed the second quarter of the year with a loss of -6.50% (including floating P/L). In this quarter, the confinement measures have given good results in terms of general infections and, above all, the hospital pressure has returned to more controlled levels. However, once the economic and social activity has returned to a certain normality, we have checked that the control of the pandemic is very complex. Little by little the infection has begun to grow uncontrollably and the summer tourist season, for example in Spain, has been disastrous. Society is experiencing unprecedented uncertainty. Governments and central banks are trying to manage the situation with their instruments (liquidity injections, financial aid…) a potentially catastrophic situation without knowing exactly how long it will last.

Our management has suffered another negative quarter. In a currency market highly controlled by central banks, our systems fail to find good chances to make profits. All FX pairs have suffered more or less pronounced losses, although with lower percentages than in other quarters.

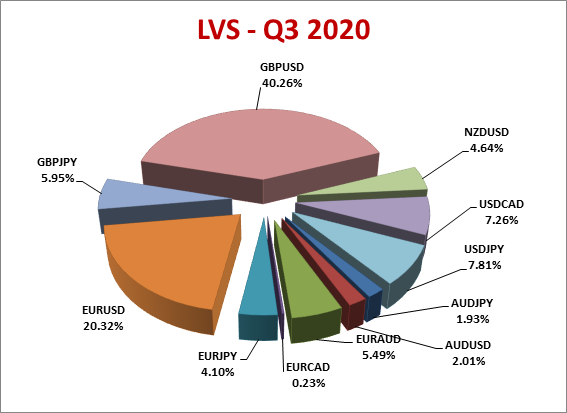

Below you can see the table corresponding to each cross negotiated by volume:

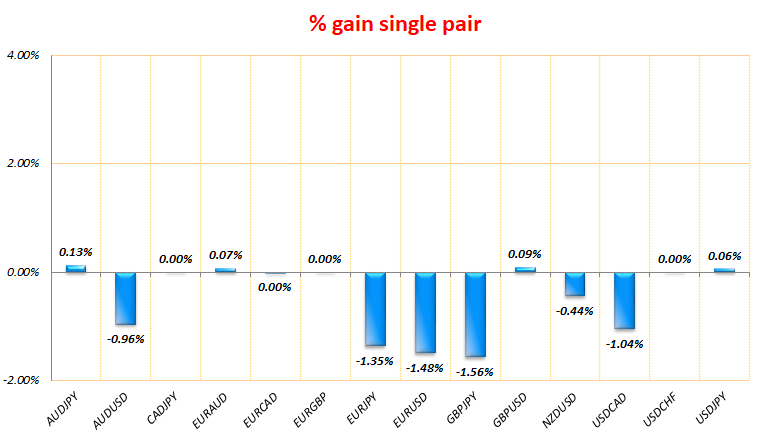

Next is the chart that represents quarterly profits/losses of each FX pair in the underlying account. Few crosses have escaped losses:

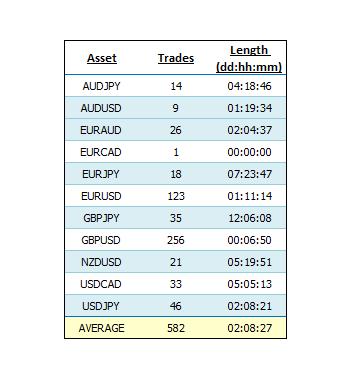

Below you will find the table detailing the number of trades and the average duration of each FX pair during this quarter. The overall duration was considerably lower than the previous quarter mainly because scalping systems were more active:

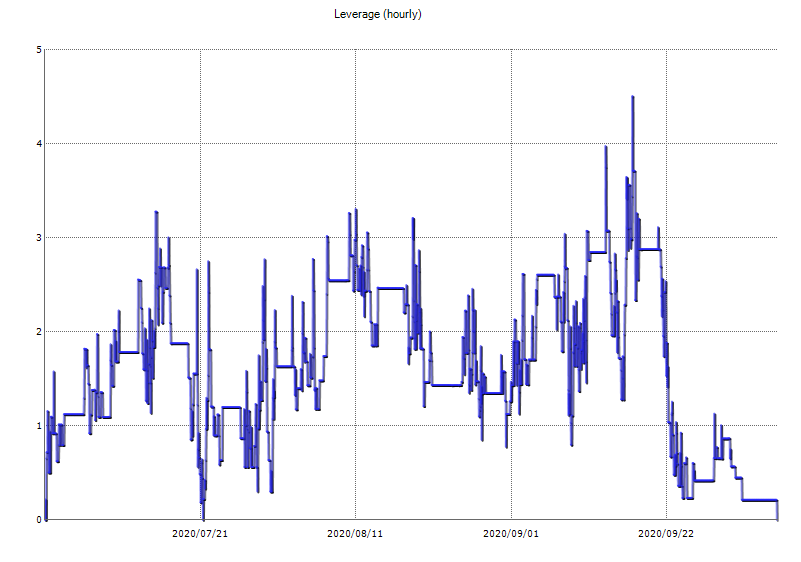

Leverage has remained very low because the activity of the systems has been quite limited:

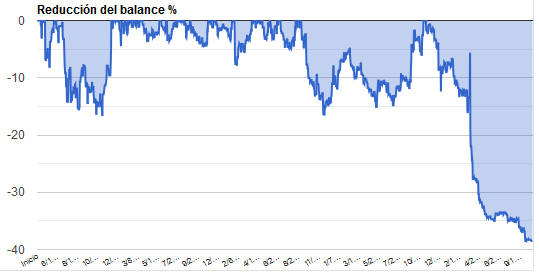

Finally, we close with the drawdown chart that unfortunately follows its negative dynamics:

Trading view and expectations

We are clearly disappointed with the results and we are reviewing systems to find a way to generate value in this market. We will continue with the low leverage we have at the moment until we can see volatility more favorable to the kind of management we have.

Sincerely,

Feycox Development S.L.