ANALYSIS SECOND QUARTER 2020

Context

The underlying LVS account in Darwinex has closed the second quarter of the year with a loss of -9.00% (including floating P/L). In this quarter several events have happened at different levels. At a social level, states have had to take drastic measures to stop the spread of COVID-19. Lockdown measures, more extreme in some countries than others, have stopped the economy as a whole and, although at the end of this quarter seems that the activity is recovering, contagions in many regions of the world still remain out of control. Central banks are trying to give liquidity with all possible means, but there is a general consensus that real damage to the economy will be seen from the third quarter of the year.

Our management has suffered another negative quarter. April and May have continued the negative trend of the previous quarter with many trades touching their stop losses. In June we achieved a more hopeful outcome. In this quarter there have been two important events: First, the changes made by Darwinex on the VaR level (now at 6.5%) and the change on investor’s commissions. We will comment this point later in “Expectations” section. Second, we have had to suspend trading for around two weeks for administration reasons and we have used this break to fix some parameters of the portfolio adapting them to the new VaR range.

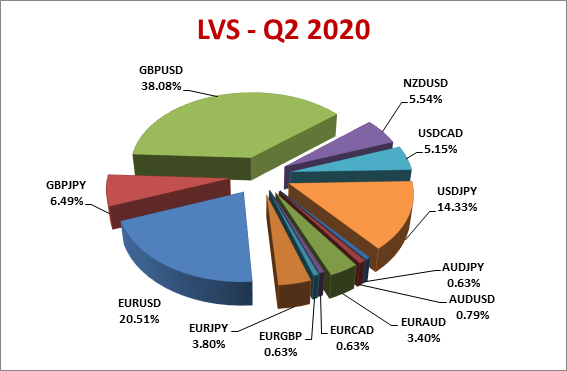

Below you can see the table corresponding to each cross negotiated by volume:

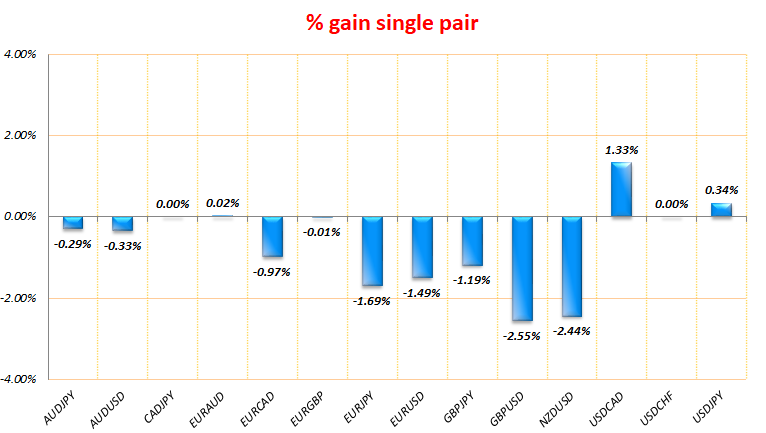

Next is the chart that represents quarterly profits/losses of each FX pair in the underlying account. As you can see the losses are spread across all pairs. Only USDCAD and USDJPY had positive result:

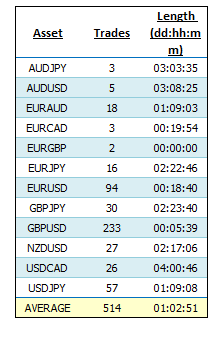

Below you will find the table detailing the number of trades and the average duration of each FX pair during this quarter. The overall duration was considerably lower than the previous quarter mainly because scalping systems were more active:

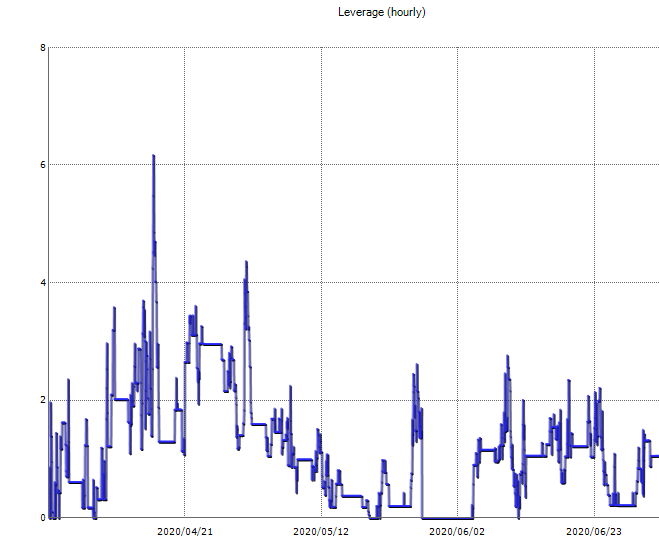

We also want to show the leverage used in this quarter. It is historically lower than normal because of the new VaR adaptation and for staying prudent in a period not favorable for our strategies:

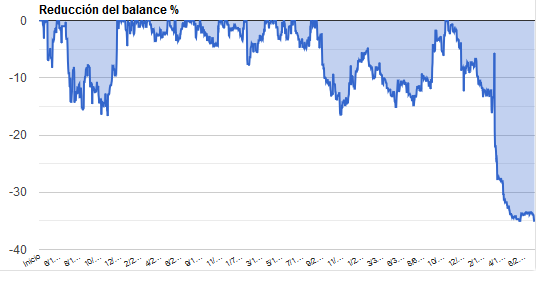

We finish with the drawdown graph:

Trading view and expectations

Darwinex’s change in the objective VaR has forced us to make some changes in our trading plan. The range is now between 3.25% and 6.5%. Because of that we have lowered the average lots to adapt the underlying account to the new range. Although we understand Darwinex’s purpose with this change, we believe that the modification could be published with more time to give traders the opportunity for adaptation if necessary. We hope this change will remain for the long term.

Finally, we want to thank all our investors for continuing to trust in LVS and our “Long Vision” philosophy. As always, we continue working to achieve positive results in our trading.

Sincerely,

Feycox Development S.L.