ANALYSIS OCTOBER 2018

Context

October was again a negative month where the uncertainty has tested our strategies. Some pairs of currencies have experienced good performance but in general we had a negative result. The worst results came from EURAUD (-1.73%) and EURJPY (-1.59%). Majors crossrates with Bristish Pound have been slightly negative looking for a recovery in the second half of the month but still closing with a result of -0.77%. EURUSD has had also a negative month (-0.76%) especially in the first half of the month. Among the currencies with positive yield we highlight the Canadian Dollar that, after a disappointing results in September, have obtained +3.55%.

Brexit negotiations are still open and false breakouts in GBP has tested the robustness of our systems. In addition to this, volatility in stocks markets is rising. Our forecast is that volatility will also move to forex markets and hope to take advantage of greater and deeper movements.

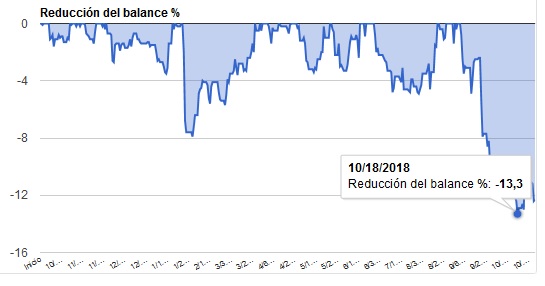

We know that our way of trading may suffer from marked drawdown periods but we also know that it can capitalise a possible increase of volatility and a greater directionality. Below is Long Vision FX’s drawdown evolution.

Trading View

In July’s letter we talked about we had added some sets with longer timeframes in Long Vision FX looking for more significant movements. For now this package of systems has not yet paid off but we believe that with greater volatility these changes will bring a lot of value. Although our trading is automatic (algorithmic trading), we are always monitoring markets general context. In this case we have chosen a working guideline aimed at an increase in volatility, which in the short term may be more penalizing, but in the future will have a good risk-reward ratio.

At the operational level, we are reviewing some strategies to check if we find any signs of significant stagnation. Our intention is to reduce the weight of scalping systems and, as a new line of work, we are also studying some “trend following” systems to implement them in the first quarter of 2019. Our view is focused on the long term and always with purpose of improving the portfolio.

Sincerely,

Feycox Development S.L.