ANALYSIS NOVEMBER 2018

Context

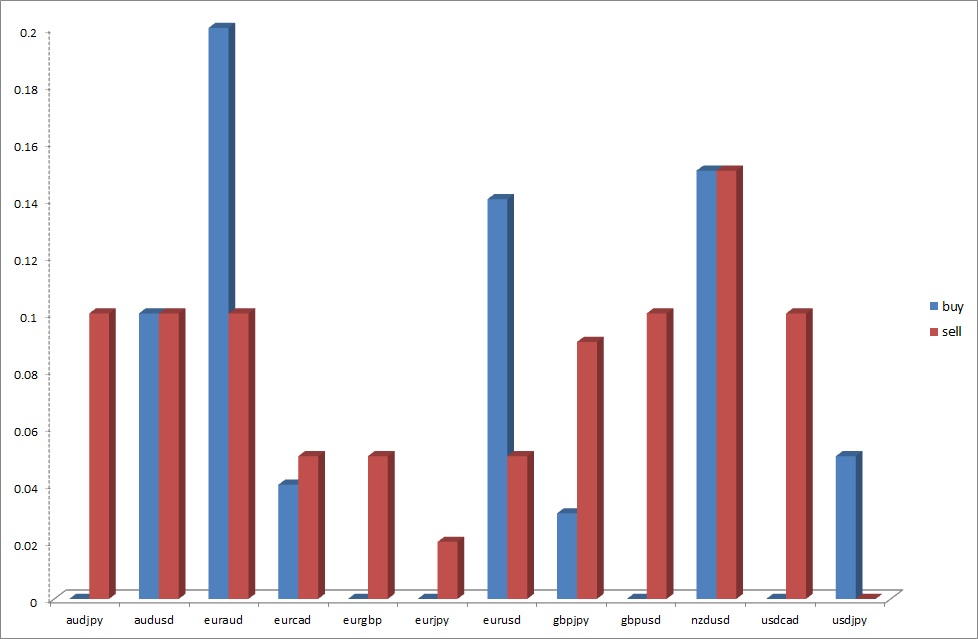

Long Vision FX’s account in Darwinex has finished November with a loss of -7.16% (including floating balance). Most of currencies pairs had a fairly neutral behavior. We highlight the +1% of USDJPY and -1.25% of EURAUD. British pound (GBPUSD and GBPJPY) with -2.7% has concentrated their negative results in the first part of the month. In the second half, the pound has attempted a recovery coinciding with the end of Brexit’s negotiations. Canadian dollar has contributed only with +0.27% in its crossings. At the end of the month, we have a relevant negative floating with many trades opened in the last 10 days. Below is the graphic of open trades with the corresponding lot size:

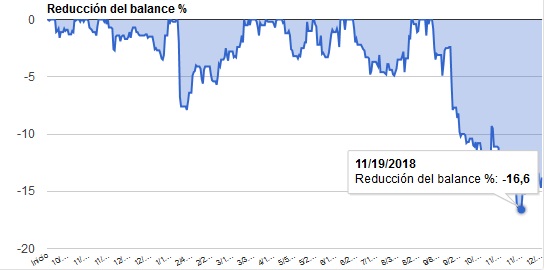

Talking about drawdown level, the underlying account of LVS has reached its maximum historical drawdown at the end of the month (-20% including floating P/L). Next we will comment the changes we have made during the last weeks to improve the portfolio.

Trading View

As discussed in October’s report, we keep our view on a future rise of volatility. However, we cannot ignore that we have reached a low volatility level on markets unknown by our portfolio. For this reason, we have decided to implement the following changes:

- Give greater weight to most recent market conditions, especially in shorter timeframes. At operational level, this means that we will review the whole portfolio every 2 – 6 months giving priority to 15 and 30 minute sets.

- Remove strategies of 5 minute sets. Risk/reward ratio has not been satisfactory. From now on, settings in longer timeframes will have a greater weight and the average duration per trade will increase.

- Reduce even more the weight of scalping systems. After analyzing the behavior of these strategies, we have decided to reduce them as long as these market conditions persist.

We will keep the same currency diversification reducing slightly the weight of EURUSD and GBPUSD, where the 5 minute sets had more weight.

These changes have been done at the end of November so we expect to see better results in the coming months.

Sincerely,

Feycox Development S.L.